Filter by:

Filter by:

The United States is a global hub for securities trading of all types and, as a result, it’s also an active venue for shareholder...

When it comes to securities class actions, harmed investors enjoy a straightforward claim filing process in the United States, where...

At Financial Recovery Technologies, one of our core differentiators is our service model which we measure annually. We wanted to share...

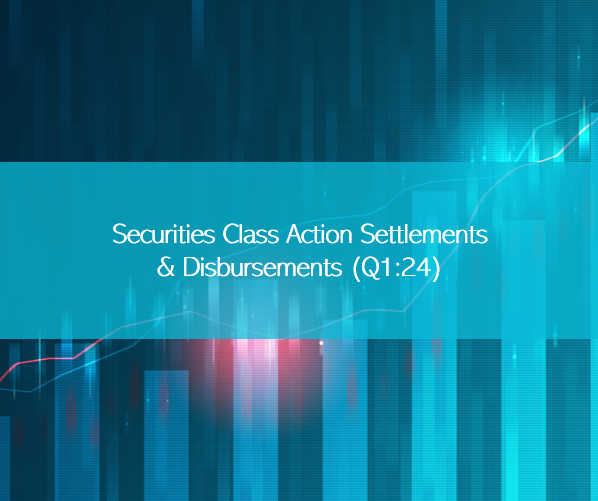

The shareholder litigation landscape remained as busy as ever in the first quarter of 2024, as our team tracked nearly $675 million in...

The global recovery landscape is not static. It’s constantly evolving, creating challenges for fiduciaries trying to stay on top of...

Each year, Financial Recovery Technologies hosts a comprehensive webinar reflecting on the investment recovery landscape. If you missed...