Why Global Investors Shouldn’t Ignore U.S. Securities Class Actions

The United States is a global hub for securities trading of all types and, as a result, it’s also an active venue for shareholder litigation.

Each year since 2018, more than 200 securities class actions have been filed in the U.S., along with 15 other specialized actions (e.g., SEC Fair Funds).

Even for investors focused outside of the country, U.S. litigation matters because many non-U.S. issuers’ shares or American Depositary Receipts (ADRs) trade on U.S. exchanges. In fact, roughly 20% of U.S. shareholder class actions each year target companies headquartered elsewhere.

As a result, some non-U.S. shareholders can file claims both in the U.S. courts and locally, so long as they can establish a nexus between their trades and the forums for suit.

FRT’s global clients often ask whether they should pay attention to U.S. securities class actions if their investment focus is elsewhere. Even if they are not trading foreign issuers’ instruments on U.S. exchanges, our answer is “yes” for three key reasons:

- U.S. securities laws offer stronger protections and potential recovery opportunities for investors in American exchange-traded securities. So, if fraud occurs, deciding to invest in these issuers through their U.S. exchange-traded securities can offer financial redress. For example, disputes involving Luckin Coffee (China ) and VW (Germany) have already reached sizable settlements in the U.S. Outside the U.S., no suits were filed against the former, while suits against the latter remains unresolved with no end in sight.

- Section 1782 discovery under U.S. federal code allows non-U.S. litigants to seek access to relevant evidence in U.S. securities class actions, which can aid the prosecution of shareholder claims in non-U.S. countries where plaintiffs do not have this level of discovery power. In the U.S., court pleadings are publicly available and offer a treasure trove of insight into corporate stewardship activities, including proxy voting.

- American legal proceedings often move faster than those in other countries. While a more efficient settlement process can deliver investor awards sooner, U.S. settlements may also potentially impair international recovery efforts. Case in point: a recent release in the Toshiba Corp. class action settlement required investors suing the company in Japan to ‘opt-out’ to avoid jeopardizing their claims in that country.

Read more: Section 1782 Proceedings in the US: Privacy Warning

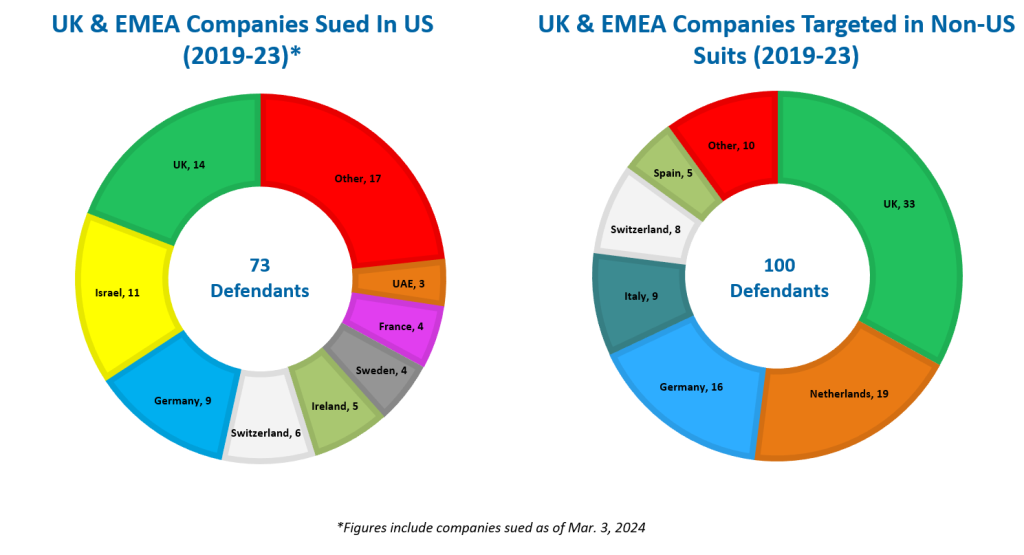

Spotlight: United Kingdom and EMEA

Some countries that appear more frequently in U.S. suits – such as Israel, Ireland, and France – have little-to-no class action opportunities locally. The U.S. could be an investor’s only path to recovery in these situations.

The opposite is also true: countries with a higher number of suits filed domestically can be less likely to see their domestic companies targeted in the U.S., particularly when trading volumes for their non-U.S. exchange traded securities are too small to economically support class action suits. The Netherlands, for example, has become a go-to venue for securities suits because of its manageable recovery process. Yet during the years shown, only two Dutch companies were sued in U.S. securities class actions.

Cases that are pursued both in the U.S. and locally usually target larger issuers, such as Petrobras, where trading volumes of foreign shares and ADRs are much higher.

Read more: Monitoring and Mitigating Adverse Cost Risk in U.K. Securities Suits

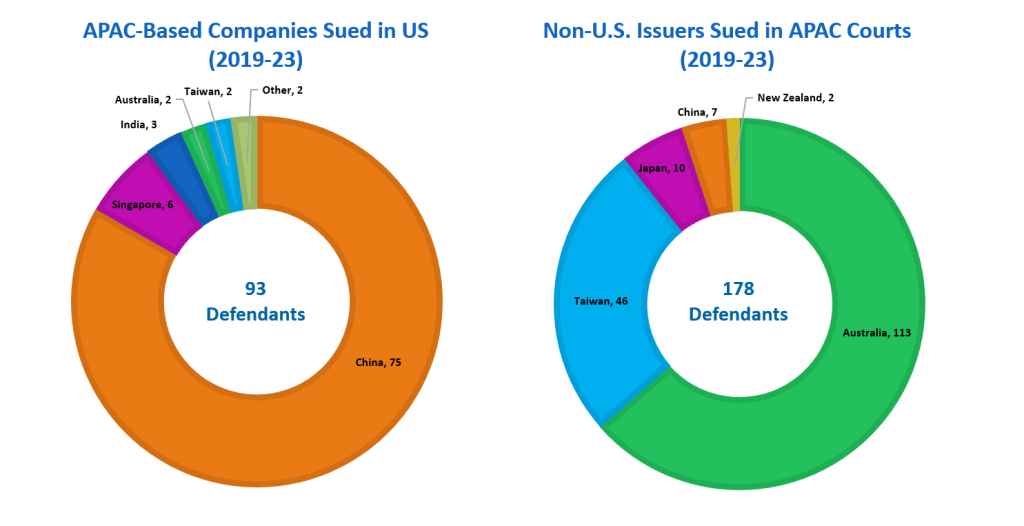

Spotlight: APAC

Like the U.S., Australia takes a “passive” approach to securities class actions. Investors can register during an initial opt-in period or before a court-ordered opt-out date, and then wait for the case to resolve without exposing themselves to adverse cost risk or disclosure.

This straightforward process is reflected in the high number of Australian companies sued locally versus the U.S., where there will be limited or no significant trading of U.S. exchange-traded shares.

However, the U.S. remains a superior recovery venue for securities suits that target defendants in legally challenging jurisdictions. China and India, two of world’s five largest economies by GDP, both fall in this bucket – very few class actions are brought in their courts.

Final Takeaways

Global investors need to be thoughtful when it comes to securities class action participation, whether in the U.S. or elsewhere. When possible, concentrate your firm’s recovery efforts in venues where the risks and legal burdens are low – and carefully consider the costs and benefits of any international opt-in claims before joining.