Lessons learned from the Credit Default Swap (CDS) Antitrust Case

In the Credit Default Swaps Antitrust Litigation, plaintiffs sued on behalf of purchasers or sellers of credit default swaps (CDS) alleging the defendants engaged in anticompetitive acts that affected the market in violation of Section 1 of the Sherman Act, 15 U.S.C. § 1. It also alleges they were unjustly enriched by their misconduct.

To date, partial settlements have recovered and distributed to eligible claimants more than $1.86 billion, an amount exceeding the vast majority of securities class action settlements. Only seven securities cases in history have settled for more. Many of FRT’s clients received large distributions, highlighting the enormous opportunity for fiduciaries in the antitrust space.

To date, partial settlements have recovered and distributed to eligible claimants more than $1.86 billion, an amount exceeding the vast majority of securities class action settlements. Only seven securities cases in history have settled for more. Many of FRT’s clients received large distributions, highlighting the enormous opportunity for fiduciaries in the antitrust space.

Antitrust cases involve legal claims and processes for recovery different than those of securities cases, and therefore require a tailored approach to servicing each case. Specific to CDS:

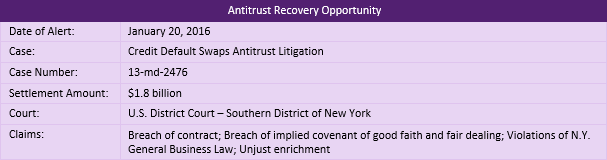

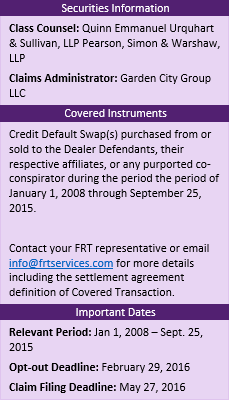

- FRT issued an Alert on January 20, 2016 to clients potentially eligible to recover funds from the CDS settlement.

- FRT helped clients gain portal access to view transaction data and determine eligibility.

- For clients believing the transaction details on the administration site was incomplete, FRT helped them supplement the trade histories associated with their claims and reconcile their internal records against those shown by the claims administrator. FRT was successful in supplementing client claims and having them accepted by the administrator.

CDS Client Success Stories: Lessons Learned

- Early notification is key to ensuring clients have enough time to review, pull data, map transactions and calculate recognized loss: In some cases, clients did not receive the initial notice from the Claims Administrator to gain access to the portal. Tracking down login credentials was made easier by FRT’s strong relationships with claims administrators.

- Data needed was not standard: In the CDS case, Class Counsel compiled the data based on CDS trading records from the settling defendants and pricing/spread information maintained by the Depository Trust & Clearing Corporation (DTCC). However the data was incomplete and FRT helped clients submit additional trades which resulted in ~10% recovery increase.

- Filing was time intensive: For some clients, the time saved by having FRT review their data, complete the form(s), and file on their behalf was significant. For one client, almost 20 hours of work was shifted to FRT, ensuring the client could focus on its core responsibilities while FRT focused on maximizing their recoveries.

ANTITRUST PIPELINE: WHAT’S NEXT?

FRT is currently tracking more than 40 antitrust cases. Some, like the Forex case which has partially settled for $2 billion, will rival or surpass the CDS settlement. Others that have settled with money in escrow include ISDAfix ($380.5 million to date), Gold and Silver Fixing ($90 million to date) and LIBOR ($120 million from just one defendant with more expected in coming months). Others being litigated that may settle in the future include Treasury Bonds, SSA Bonds, SIBOR (Singapore benchmark rate manipulation), BBSW (the Australian benchmark rate manipulation).

The magnitude of the CDS case and depth of FRT’s antitrust pipeline make the fiduciary case even stronger – institutions should have processes in place to systematically track all recovery opportunities in this area so they don’t miss out on the next recovery opportunity.

FOREX: The $2b antitrust settlement (to date)

In re Foreign Exchange Benchmark Rates Antitrust Litigation (also referred to as “FX” or “Forex”) concerns alleged manipulation of the FX market – the world’s largest and most actively traded financial market – between January 1, 2003 and December 15, 2015. Currently, nine defendants have agreed to a pay a total of more than $2 billion to resolve claims against them. Several defendants have yet to settle.

On December 20, 2016, the U.S. District Court for the Southern District of New York issued an order preliminary approving the notice, claim form and plan of distribution. We expect these documents will be distributed to eligible class members in May 2017. The Court has also scheduled a final fairness hearing on October 18, 2017. Learn more about the upcoming FOREX litigation.

RELATED MATERIALS

For more information on this case or other securities, global, and antitrust class action litigations, please contact Financial Recovery Technologies at info@frtservices.com

About FRT

U.S. CLAIMS I GLOBAL GROUP LITIGATION I ANTITRUST I LITIGATION MONITORING I BUYOUTS

Founded in 2008, Financial Recovery Technologies (FRT) is the leading technology-based services firm that helps the investment community identify eligibility, file claims and collect funds made available in securities and other class action settlements. Offering the most comprehensive range of claim filing and monitoring services available, we provide best-in-class eligibility analysis, disbursement auditing and client reporting, and deliver the highest level of accuracy, accountability and transparency available. For more information, go to www.frtservices.com.

- Follow us on Twitter: @FRTServices

- Follow us on LinkedIn: Financial Recovery Technologies

- Email us: learnmore@frtservices.com

This communication and the content found by following any link herein are being provided to you by Financial Recovery Technologies (FRT) for informational purposes only and does not constitute advice. All material presented herein is believed to be reliable but FRT makes no representation or warranty with respect to this communication or such content and expressly disclaims any implied warranty under law. Opinions expressed in this communication may change without prior notice. Firms should always seek legal and financial advice specific to their unique situation and objectives.