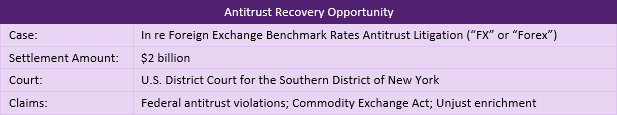

FX Case Spotlight: Partial settlement of over $2B in Forex case involves complicated antitrust issues and FX trading

CASE BACKGROUND

This antitrust class action concerns alleged manipulation of the FX market, the world’s largest and most actively traded financial market. The suit centers on collusion among several major FX dealers to artificially set certain key rates in order to enhance profits and reduce the value of customer FX transactions. Currently, nine defendants have agreed to pay a total of more than $2 billion to settle claims against them. Several other defendants have yet to settle.

Case Timeline (As of March 15, 2017 when blog was published. Note new preliminary timeline as communicated on June 1 in our FX Case Update):

- March 31, 2014: Plaintiffs filed a consolidated amended complaint against major dealer bankers, alleging anticompetitive conduct in the foreign currency exchange (FX) market.

- January 28, 2015: The court partially denied the defendants’ motions to dismiss the class action.

- December 20, 2016: The U.S. District Court for the Southern District of New York issued an order preliminary approving the notice, claim form and plan of distribution.

- May 2017: “Plaintiffs continue to engage in confidential settlement discussion and data collection and propose to update the Court by filing a status report on or before June 1, 2017, on which date Plaintiffs anticipate providing the Court with a proposed timeline for notice.”

- June 1, 2017: Plaintiffs provided the Court a preliminary timeline of notice for re Foreign Exchange Benchmark Rates Antitrust Litigation. Click here to read the filed letter.

The settlements break down as follows:

Estimating Your Losses:

The proposed Recognized Loss formula is complex. As in prior antitrust settlements – most recently, the credit default swap (CDS) matter – the Claims Administrator will use information obtained from the settling defendants and third-party sources to try to construct your eligible transaction details and estimate your losses. During the claims submission process, you can either (a) accept their trade details and estimated loss amount, or (b) submit documentation showing actual transaction volumes based on your own records. Which option you choose will depend on the nature of your trading activity. If you traded only with the non-settling defendants or on an exchange, you will need to submit your own records as the Claims Administrator will not have access to this information.

RELATED MATERIALS

- FX Case Update (October 2017): Online Claims Portal Is Now Open

FX Case Update (August 2017): Five Additional Defendants Settle Bringing the Settlement Pool to Over $2 Billion - FX Case Update (June 2017): Preliminary timeline and expected preliminary approval of settlement with five more defendants

- Whitepaper: Antitrust – The Evolving Fiduciary Landscape

- Whitepaper: 2016 Year In Review – Global, Antitrust and U.S. Securities Class Action

- FX FAQ: How will eligibility be determined?

- FX FAQ: How do I know whether I’m eligible for recovery?

- FX FAQ: When is the claims administration process likely to begin?

For more information on this case or other securities, global, and antitrust class action litigations, please contact Financial Recovery Technologies at learnmore@frtservices.com.

About FRT

U.S. CLAIMS I GLOBAL GROUP LITIGATION I ANTITRUST I LITIGATION MONITORING I BUYOUTS

Founded in 2008, Financial Recovery Technologies (FRT) is the leading technology-based services firm that helps the investment community identify eligibility, file claims and collect funds made available in securities and other class action settlements. Offering the most comprehensive range of claim filing and monitoring services available, we provide best-in-class eligibility analysis, disbursement auditing and client reporting, and deliver the highest level of accuracy, accountability and transparency available. For more information, go to www.frtservices.com.

- Follow us on Twitter: @FRTServices

- Follow us on LinkedIn: Financial Recovery Technologies

- Email us: learnmore@frtservices.com

This communication and the content found by following any link herein are being provided to you by Financial Recovery Technologies (FRT) for informational purposes only and does not constitute advice. All material presented herein is believed to be reliable but FRT makes no representation or warranty with respect to this communication or such content and expressly disclaims any implied warranty under law. Opinions expressed in this communication may change without prior notice. Firms should always seek legal and financial advice specific to their unique situation and objectives.